Inflation Reduction Act of 2022 – New Tax Credits for Manufacturers of Clean Energy Equipment

TEL: +1 608-238-6001 Email: greg@salgenx.com

Saltwater Redox Flow Battery Technology Report Salgenx has released its Saltwater Redox Flow Battery Technology Report, a pivotal resource that delves into the century-old technology recently validated by a $7 million US Military investment and experiments by the Pacific Northwest Laboratory. More Info

Our new cathode materials can do the following: • Self-healing electrode • Self-optimizing material • While charging, the system will automatically enhance itself and build conductivity. This system is revolutionary, and the only type of battery that can accomplish these tasks automatically while in use.

Manufacturing Licensing Now Available Price based on cathode material. Now discovering high surface area clays as potential cathode material lowering cost of deployment. Verified working as of 5 July 2024. More Info

Research and Development Notes Now Available Save years of research by purchasing our development... More Info

|

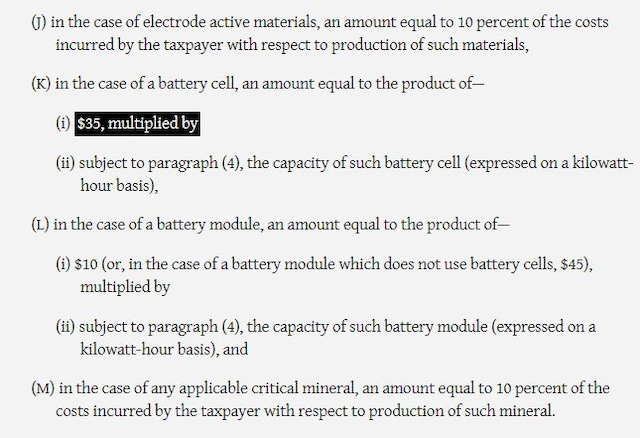

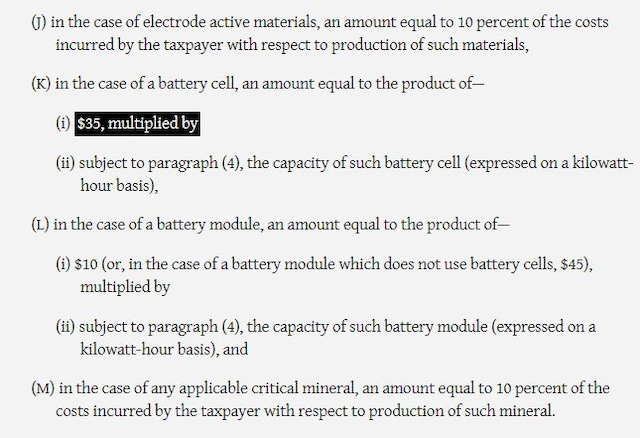

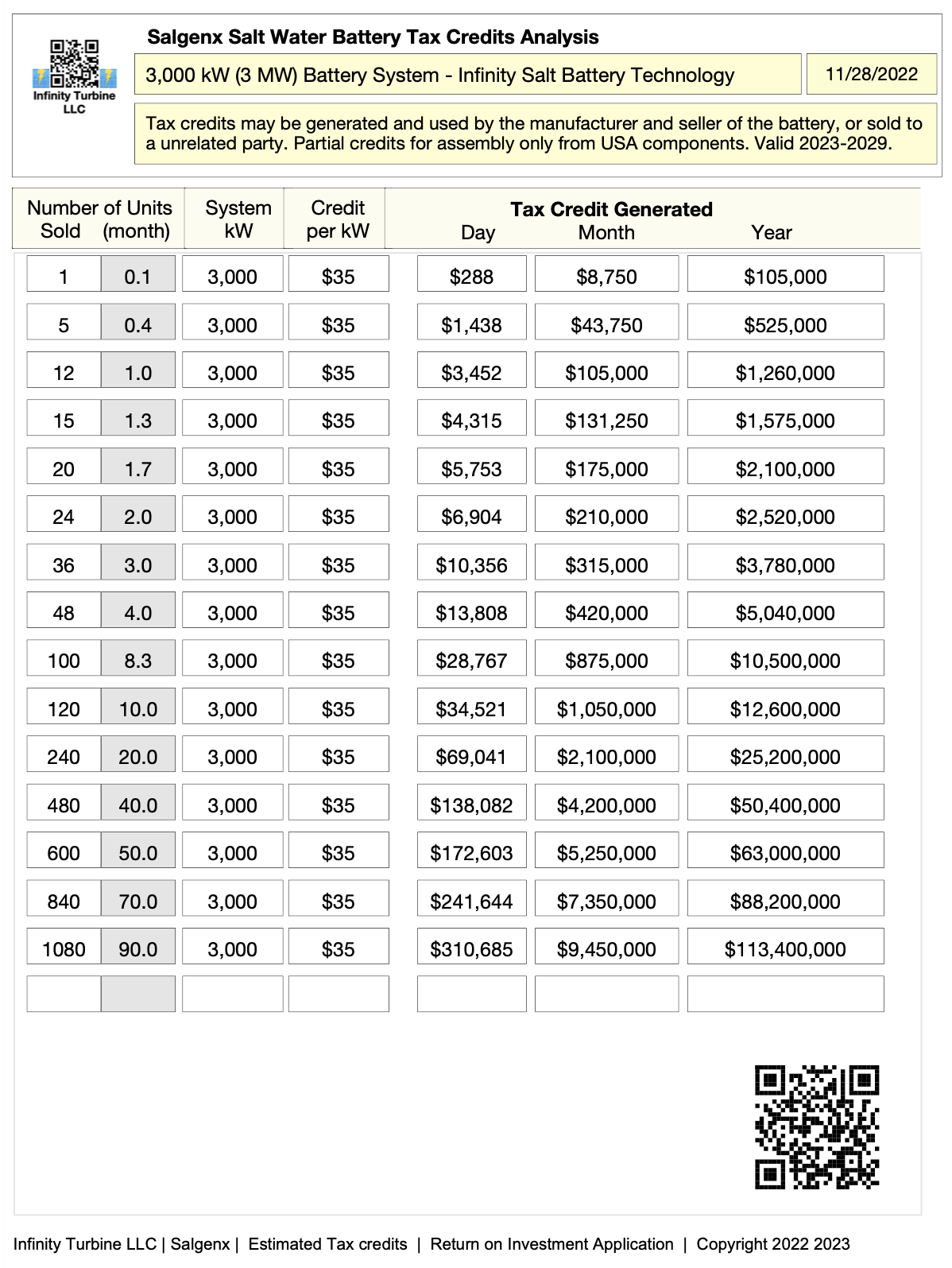

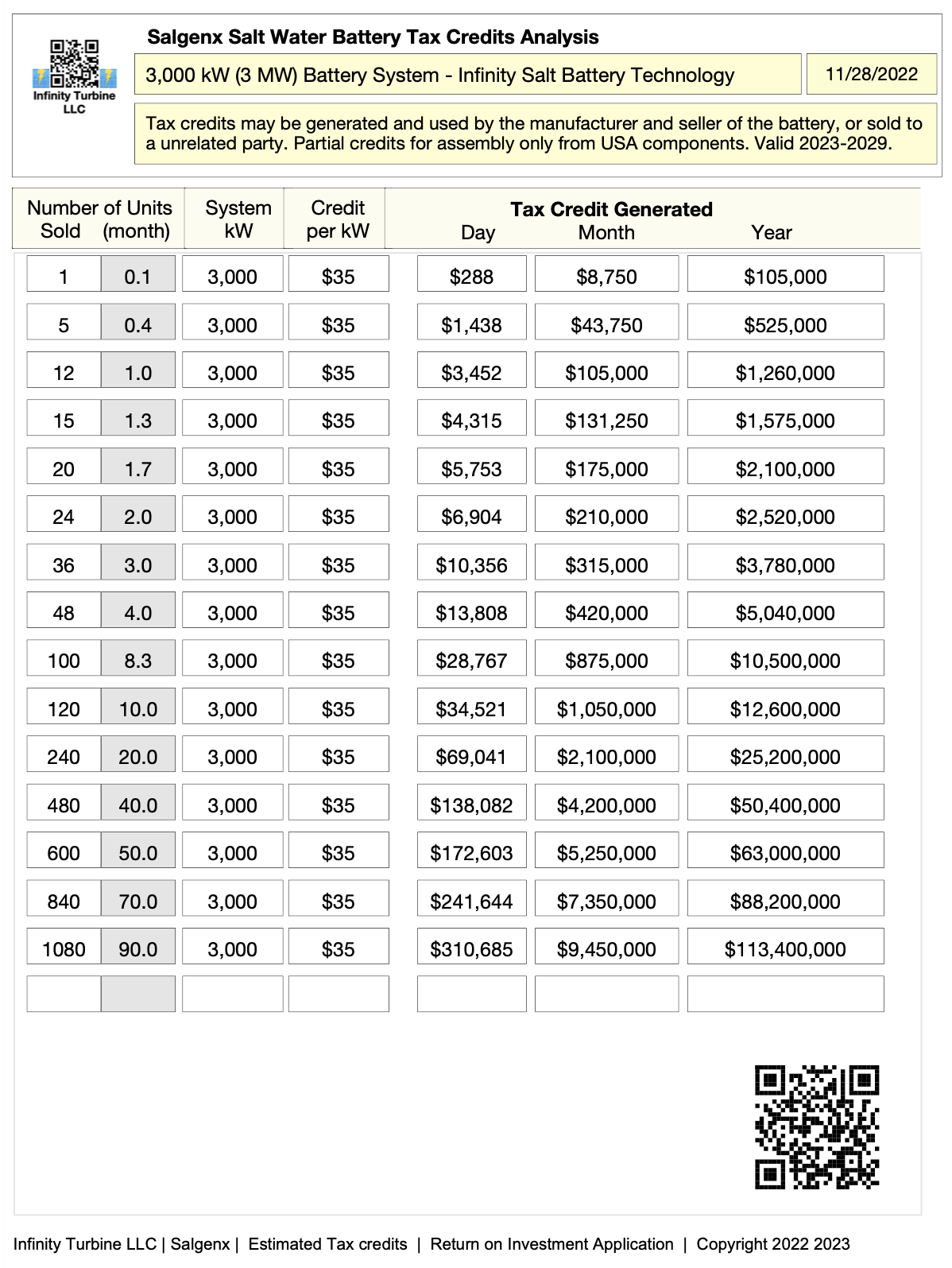

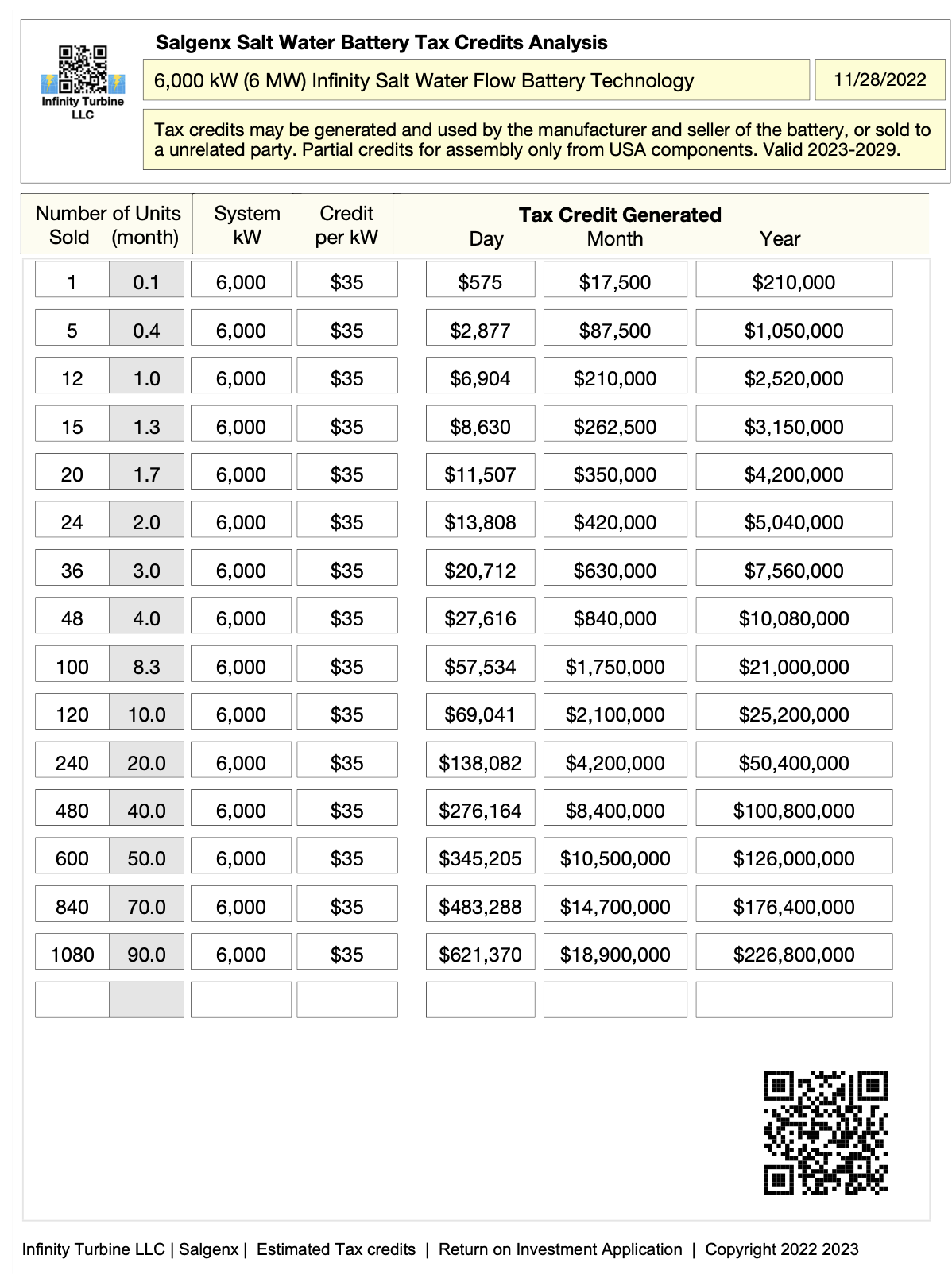

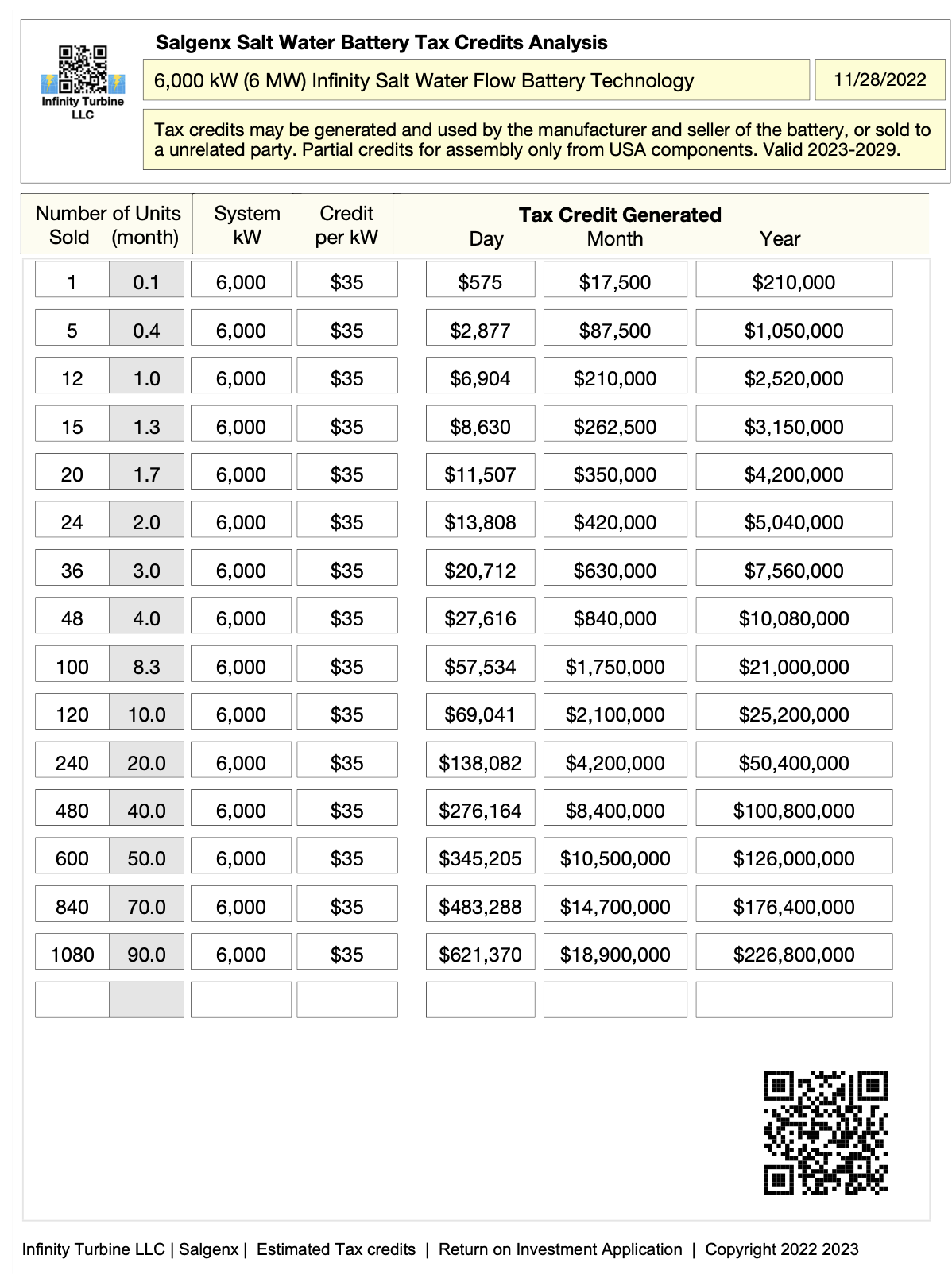

Salgenx S3000 (3,000 kW) Commercial Flow Battery: $35 x 3,000 kW = $105,000 per unit soldSalgenx S6000 (6,000 kW) Commercial Flow Battery: $35 x 6,000 kW = $210,000 per unit soldUtility Scale Flow Battery Bank: $35 x 6,000 kW x 100 = $21,000,000Note: The credit would apply to components produced now, and would begin to phase out starting in 2030. Access: Electrochemical cell comprised of one or more positive electrodes and one or more negative electrodes, with an energy density of not less than 100 watt-hours per liter (.1 kW/L), and capable of storing at least 20 watt-hours of energy.

Section 45X of the IRA which covers the Advanced manufacturing production credit. For makers of battery cells, it provides for $35 per kilowatt-hour (kWh) Inflation Reduction Act of 2022 – New Tax Credits for Manufacturers of Clean Energy Equipment |

Monetize the Tax Credit |

Monetize the Tax Credit Manufacturers can also monetize the tax credit through a direct payment from the Internal Revenue Service (IRS) is lieu of a credit against their taxes due, or opt to transfer the credit, as described below:Direct pay option: Manufacturers can receive a refund for 45X MPTC tax credits for the first five years they are claimed, though are still subject to the 2033 credit sunset. The five-year limitation does not apply if the manufacturer is a tax-exempt organization (i.e. non-profit), state, municipality, the Tennessee Valley Authority, Indian Tribal government, any Alaskan Native Corporation, or any rural electric cooperative. A penalty of 20% may apply where excess payments occur.[3]Transfer of credit: Manufacturers may also elect to transfer all, or a portion, of the tax credits for a given year to an unrelated eligible taxpayer. Payments for the credit must be made in cash and are not considered a taxable event (i.e. no taxes are owed on receiving the payment and no deduction is possible for making the payment). A penalty of 20% may apply where excess credits occur.[4][3] H.R.5376 – Inflation Reduction Act of 2022, Section 6417. Taxpayers may elect to stop receiving direct payments in subsequent years, however, once stopped, they cannot go back to direct payments.[4] H.R.5376 – Inflation Reduction Act of 2022, Section 6418. The transferee cannot further transfer any credits it received in the transfer. Monetize the tax credit (pdf page download)EnergyGov: Monetize the tax credit for manufacturing batteries |

S3000 Tax Credits for Salgenx Salt Water Flow Battery valid Until 2029 |

S3000 Tax Credits for Salgenx Salt Water Flow Battery |

S3000 Tax Credits 3,000 kW (3 MW) Infinity Salt Water Flow Battery Technology.Tax credits may be generated and used by the manufacturer and seller of the battery, or sold to a unrelated party. Partial credits for assembly only from USA components. Valid January 1st, 2023 until 2029. S3000 Tax Credits (pdf page download)EnergyGov: Monetize the tax credit for manufacturing batteries |

S6000 Tax Credits for Salgenx Salt Water Flow Battery Valid until 2029 |

S6000 Tax Credits for Salgenx Salt Water Flow Battery |

S6000 Tax Credits 6,000 kW (6 MW) Infinity Salt Water Flow Battery Technology.Tax credits may be generated and used by the manufacturer and seller of the battery, or sold to a unrelated party. Partial credits for assembly only from USA components. Valid January 1st, 2023 until 2029. S6000 Tax Credits (pdf page download)EnergyGov: Monetize the tax credit for manufacturing batteries |

| CONTACT TEL: +1 608-238-6001 (Chicago Time Zone) Email: greg@salgenx.com | RSS | AMP | PDF | IG | A Division of Infinity Turbine |